Employee-Owner Frequently Asked Questions

It means that everyone who works at the company has the opportunity to become an owner! Employee ownership ensures that everyone builds wealth when the company succeeds.

An ESOP is an Employee Stock Ownership Plan. Technically it is a retirement plan.

Your ESOP account is funded by annual contributions made by the company and the value of your account tracks closely with our success. You pay nothing for your shares and do not have to contribute to your ESOP account.

It is open to all employees who are over the age of 18 and have worked at least logged at least 250 hours in a calendar year.

It does not cost you anything!

The goal of the ESOP is to give current employees an ownership stake in our company. As a result, distribution of the benefit in your ESOP account begins when you leave the company or retire.

There is a difference between ownership and control. Ownership is about having a monetary stake in and an ability to have a positive impact on the success of the company. Control is about decision making. Just because you own shares of Coca-Cola doesn’t mean you get to pick the next flavor. We are still professionally managed and many of the normal rules of business still apply.

As a team of owners, we all have a role to play in our success. Anything you can do to increase output or save us money will help raise our share price (and the value of our ESOP accounts). Even small ideas add up to big increases when we all do our part.

Ask your supervisor or an ESOP Communications Committee member.

There are two key differences between ESOPs and 401(k) plans. First, an ESOP invests primarily in an employer’s stock rather than “Wall Street” investments. While a 401(k) plan generally offers various mutual funds in which employees may invest funds. Second, 401(k) plans permit employees to contribute their own money into the plan, while ESOP contributions are entirely company funded and there is no employee contribution. The entry provisions are also different.

The price of the stock in an ESOP is typically determined on an annual basis by an independent valuation company working in conjunction with the plan’s trustee. The value is based on many factors, including the company’s current and projected performance, the performance of similar publicly traded companies, the outlook for the industry and the geography within which the company operates, and the overall economic outlook.

Contributions for each plan year are allocated to participants who have worked at least 1,000 hours for the plan year and who are still employed by the company on the last day of the plan year –December 31st or have terminated employment during the plan year on account of Death, permanent Disability, or after reaching the normal Retirement date (age 65). On the basis of eligible compensation.

An ESOP account balance will usually change only once per year. Employees will receive an annual statement that provides the financial activity for the year, including the updated stock value. Your individual account will grow based on annual company contributions, forfeitures and increased value of the company.

KKW Manangment will continue to make the day-to-day decision making, and hiring and firing decisions. The ESOP does not guarantee employment at the company. Only in special circumstances will there be a pass through vote to the participants.

Yes, distributions are generally paid in equal annual installments over 5 years. If termination is on account of Death, permanent Disability, or Normal Retirement (age 65) payments commence by the end of the 1st plan year following year of termination. If termination is for any other reason, payments commence no later than the 6th plan year following the year of termination.

Employees are not required to sign up to be part of ESOP. However to be a participant you must be 18 or older with one year of service with 250 hours. Annually participants must work 1,000 hours in each plan year to earn shares. Employees are advised to complete a beneficiary form to ensure benefits are paid to the designated beneficiary.

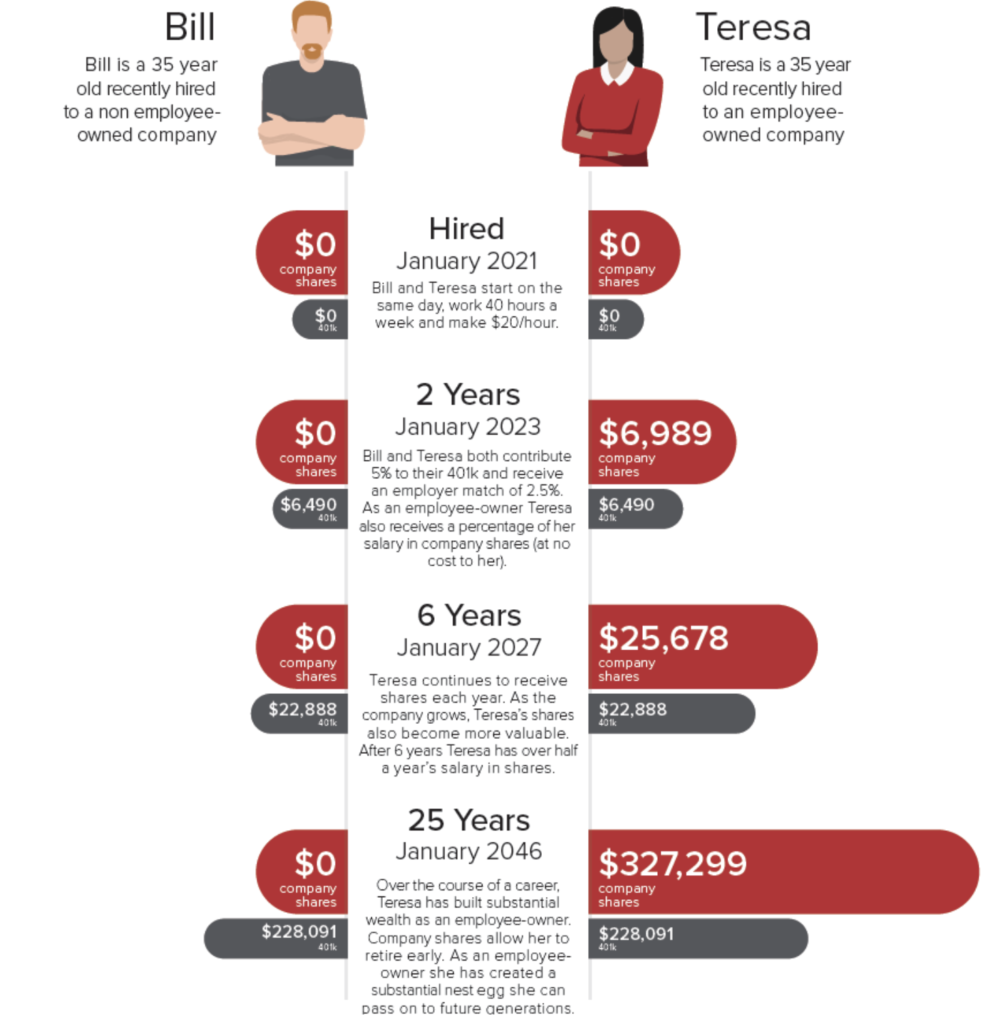

Why Does Employee Onwership Matter?

As an employee-owned company, everyone at KKW Trucking shares in our success. Yearly contributions of company shares can make a huge impact on your life. Here’s a short example of what EO could mean for you.

This is just an example and these results are not guaranteed, but we use realistic numbers.